child tax credit 2021 dates and amounts

Get Up To 26k Per W2 employee. The tool below is to only be used to help.

2021 Child Tax Credit Steps To Take To Receive Or Manage

For instance if you are filing for a single return and your.

. The maximum child tax credit amount will decrease in 2022. Big changes were made to the child tax credit for the 2021 tax year. Child Tax Credit amounts will be different for each family.

A childs age determines the amount. Its Not Too Late to Apply. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. For the 2021 tax year the child tax credit offers. Ad Only 4 Simple Steps to Claim Your Refund.

The Child Tax Credit is a tax benefit to help families who are raising children. Couples making less than 150000 and single parents also called Head. Your amount changes based on the age of your children.

The IRS pre-paid half the total credit amount in monthly payments from. Take Our Free Eligibility Quiz. Learn More at AARP.

New 2021 Child Tax Credit and advance payment details. Up to 3000 per qualifying dependent child 17 or younger on Dec. We dont make judgments or prescribe specific policies.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Our calculator will give you the answer. The increased child tax credit is reduced by 50 for every 1000 income above the thresholds.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. See what makes us different. Half of the total amount came as six monthly.

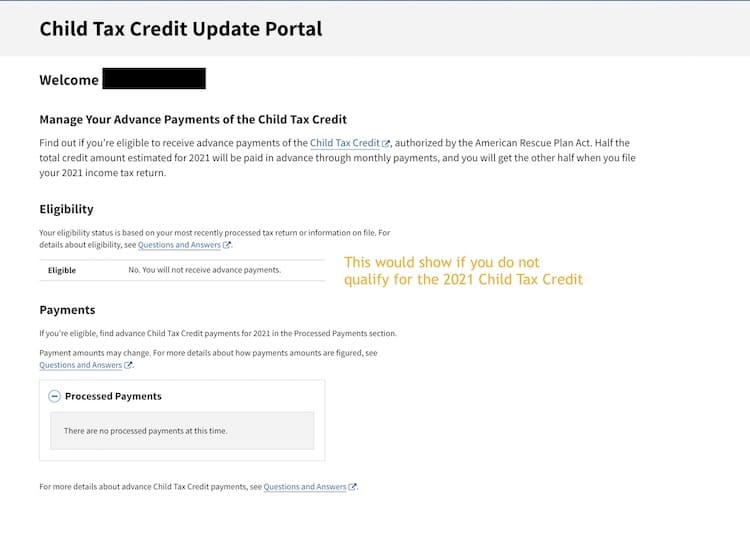

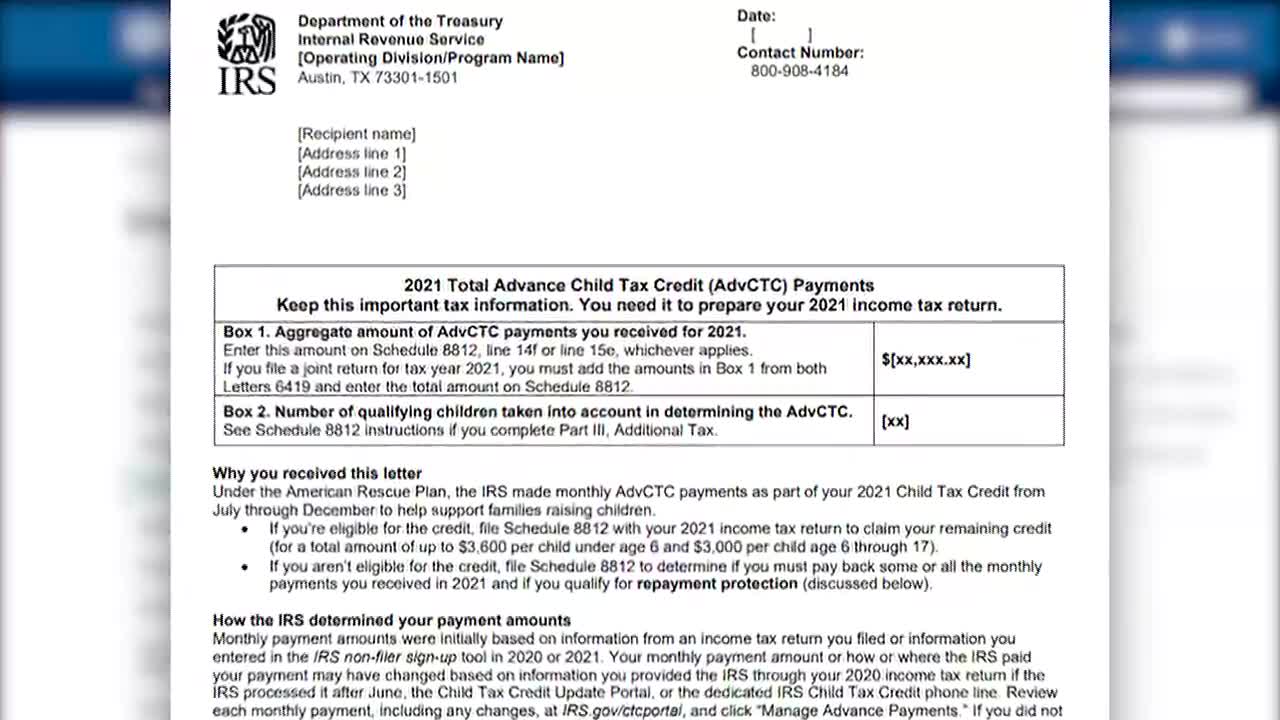

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you. For 2021 eligible parents or guardians.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Ad Only 4 Simple Steps to Claim Your Refund. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. The Child and Dependent Care Tax CreditThe child care credit is a tax credit based on your childcare expenses. The maximum Child Tax Credit payment was 3600 for each qualifying child up to age 5 and 3000 for each child age 6-17.

13 opt out by Aug. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Nearly all families with kids will qualify.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Take Our Free Eligibility Quiz. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. 15 opt out by Aug. Under the regular rules the maximum credit is 35 of childcare expenses.

Get Up To 26k Per W2 employee. The credit amounts will increase for many. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Its Not Too Late to Apply. The two most significant changes impact the credit amount and how. 31 2021Up to 3600 per qualifying dependent child under 6 on Dec.

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit Payments What S Next

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Everything You Need To Know About The 2021 Child Tax Credit Storyline Financial Planning Christian Financial Advice

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Here S What You Need To Know About The Monthly Child Tax Credit Payments New Hampshire Bulletin

Canada Child Benefit Ccb Payment Dates Application 2022

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Total Advance Child Tax Credit의 인기 동영상 찾아보기 Tiktok

Advance Child Tax Credit Payments Begin July 15

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Hersman Associates Accounting Tax Services

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wkrc